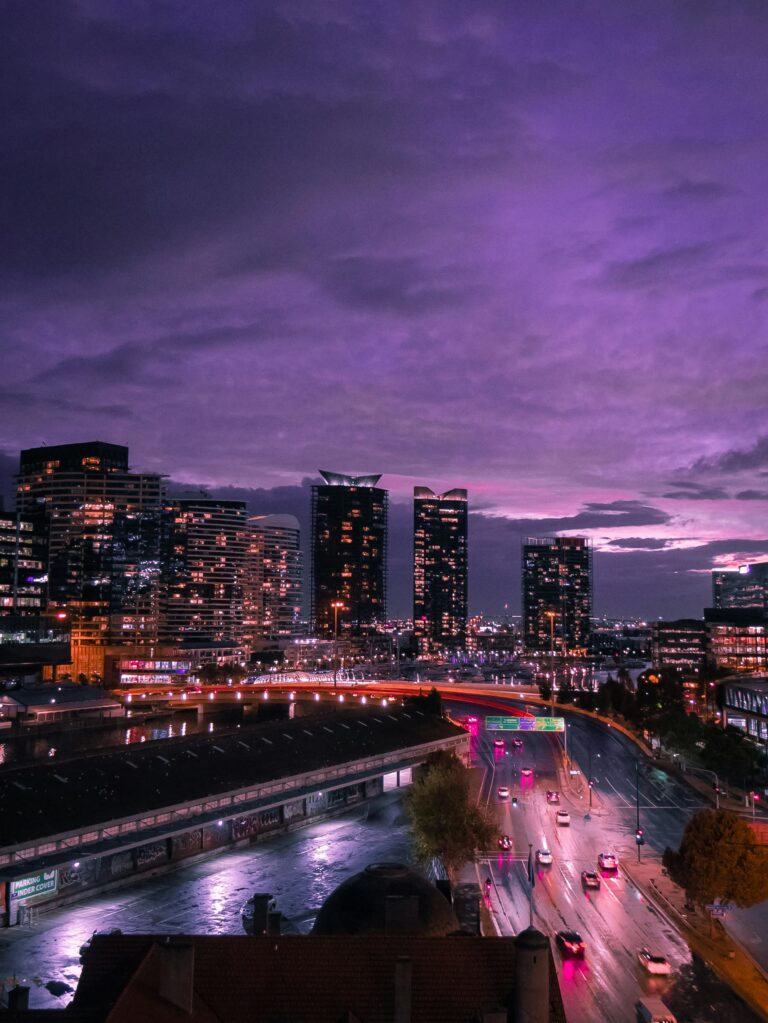

Unlocking the Secrets to Thriving in Melbourne’s Competitive Real Estate Market

The Melbourne real estate market is known for its competitive nature. With fluctuating property prices, diverse buyer demands, and fierce competition among investors, thriving in this bustling market requires strategic thinking, careful planning, and a thorough understanding of its dynamics. Whether you’re looking to buy, sell, or invest in property, unlocking the secrets to success in Melbourne’s real estate market is essential.

In this comprehensive guide, we’ll explore proven strategies and expert tips that will help you navigate the complexities of Melbourne’s real estate landscape, ensuring that you stay ahead of the competition.

1. Understanding Melbourne’s Real Estate Market Trends

Before you can succeed in any real estate market, you need to understand its unique characteristics, and Melbourne is no different. Melbourne’s real estate market is known for its diversity and resilience, but it can also be highly volatile, with property values experiencing rapid fluctuations.

Current Trends in the Melbourne Real Estate Market

- High Demand for Residential Properties: Melbourne’s growing population has led to an increased demand for housing, especially in popular suburbs and inner-city areas. Buyers are particularly interested in family homes, townhouses, and apartments.

- Booming Rental Market: The rental market in Melbourne has become increasingly competitive, with rental prices on the rise in many areas. This makes it an attractive option for property investors seeking strong rental yields.

- Affordability Issues: Like many major cities, Melbourne faces affordability challenges, especially for first-time homebuyers. This has driven demand for smaller homes and apartments, particularly in the outer suburbs where prices tend to be lower.

- Post-COVID Rebound: The Melbourne property market has bounced back after the challenges of the pandemic. With low interest rates and increased buyer confidence, property prices are steadily rising again.

2. Identifying the Right Suburbs to Buy or Invest In

Melbourne’s real estate market is divided into a wide variety of suburbs, each with its own unique appeal. To thrive in this market, you need to carefully select the areas that align with your buying or investment goals.

Top Suburbs for Buyers

- Inner-City Suburbs: Areas like Carlton, Fitzroy, and South Melbourne are known for their proximity to the city, vibrant culture, and access to amenities. These suburbs are highly sought after by both buyers and renters, but they come with a hefty price tag.

- Affordable Suburbs: For those on a tighter budget, suburbs such as Sunshine, Frankston, and Werribee offer more affordable housing options, particularly for first-time buyers. These areas are also experiencing steady price growth, making them ideal for long-term investments.

Top Suburbs for Investors

- High Rental Demand Areas: Suburbs like Richmond, South Yarra, and St Kilda have high rental demand due to their lively culture, public transport options, and proximity to the CBD. These areas offer investors the potential for solid rental returns.

- Growth Suburbs: Look out for suburbs that are poised for growth, such as Coburg, Preston, and Footscray. These areas are undergoing gentrification, with property values expected to rise in the coming years.

3. Mastering the Art of Property Negotiation

Negotiation plays a critical role in Melbourne’s competitive real estate market. Buyers and sellers alike need to master the art of negotiation to secure the best deals.

Negotiation Tips for Buyers

- Do Your Research: Before entering negotiations, research the property’s market value and recent sales in the area. This will give you a clear idea of what the property is worth and help you make a reasonable offer.

- Be Willing to Walk Away: If the seller is unwilling to budge on price or conditions, be prepared to walk away. There’s always another property on the market, and being too eager can lead to overpaying.

- Consider Pre-Approval: Having pre-approved finance can give you an edge in negotiations, as it shows the seller you’re a serious and qualified buyer.

Negotiation Tips for Sellers

- Set a Competitive Price: Overpricing your property can deter potential buyers, while underpricing can lead to lower offers. Consult with a real estate agent to determine the right price point.

- Create Urgency: Encourage competition among buyers by creating a sense of urgency. Hosting open inspections and setting a clear deadline for offers can help drive up the final sale price.

- Be Open to Offers: While you may have a specific price in mind, being flexible and open to negotiations can help close the deal faster. Sometimes accepting a slightly lower offer can save you time and stress in the long run.

4. Partnering with the Right Real Estate Agent

Choosing the right real estate agent can make or break your success in the Melbourne market. A knowledgeable agent will not only provide valuable market insights but also guide you through the entire buying or selling process.

What to Look for in a Real Estate Agent

- Local Expertise: A good agent should have in-depth knowledge of the Melbourne property market, particularly in the suburbs you’re interested in.

- Proven Track Record: Look for agents with a strong history of successful sales in your target area. They should have excellent negotiation skills and a solid network of contacts.

- Clear Communication: Choose an agent who communicates openly and clearly. They should keep you informed throughout the process and be responsive to your questions or concerns.

How to Find the Right Real Estate Agent

- Online Reviews: Use websites like realestate.com.au or RateMyAgent to find top-rated agents in your area. Look for reviews that highlight their professionalism, market knowledge, and success rates.

- Referrals: Ask friends, family, or colleagues for recommendations based on their own positive experiences with real estate agents in Melbourne.

5. Financing Your Property Purchase

Securing financing is a crucial step in the home buying process, especially in a competitive market like Melbourne. Understanding your mortgage options and finding the best loan can make a significant difference in your buying power.

Types of Home Loans

- Fixed-Rate Loans: These loans have a set interest rate for a specified period, offering stability and predictable monthly payments.

- Variable-Rate Loans: With variable-rate loans, the interest rate can fluctuate, meaning your monthly payments may increase or decrease over time. However, these loans often offer more flexibility than fixed-rate loans.

- Interest-Only Loans: Investors may consider interest-only loans, where you only pay the interest on the mortgage for a set period. This can lower initial payments but requires careful planning for future repayments.

Tips for Securing Financing

- Improve Your Credit Score: A higher credit score can help you secure a better interest rate on your mortgage. Be sure to pay off debts, avoid taking out new loans, and monitor your credit report for errors.

- Save for a Larger Deposit: The larger your deposit, the lower your loan-to-value ratio (LVR). This can help you avoid paying Lenders Mortgage Insurance (LMI) and give you better loan options.

- Get Pre-Approval: Securing pre-approval for your loan will give you a clear idea of your borrowing power and show sellers you’re a serious buyer.

6. Embracing Property Investment Opportunities

Melbourne’s competitive real estate market offers a wealth of investment opportunities, but navigating these waters requires careful planning and foresight.

Investment Strategies

- Buy and Hold: This long-term strategy involves purchasing property and holding onto it for several years to take advantage of capital growth. Popular areas for this strategy include Melbourne’s inner-city suburbs and growth corridors.

- Rentvesting: Rentvesting is becoming a popular option for first-time buyers in Melbourne. This strategy involves purchasing an investment property in an affordable suburb while renting in a more desirable area. It allows you to build equity in a property without sacrificing your preferred lifestyle.

- Flipping: For more experienced investors, flipping involves buying properties in need of renovation, making improvements, and selling them for a profit. However, this strategy requires a keen eye for potential and knowledge of the local market.

7. Staying Informed and Adapting to Market Changes

The key to long-term success in Melbourne’s real estate market is staying informed about market trends, government regulations, and economic factors that can impact property values.

Keeping Up with Market News

- Follow Real Estate News Websites: Websites like realestate.com.au, Domain, and the Australian Financial Review offer regular updates on the property market, helping you stay informed about the latest trends and opportunities.

- Attend Auctions and Inspections: Even if you’re not actively buying or selling, attending auctions and inspections can give you a feel for the market and help you understand current buyer behavior.

- Join Real Estate Forums: Online forums and social media groups dedicated to Melbourne real estate can provide valuable insights, tips, and advice from other buyers, sellers, and investors.

Adapting to Market Changes

- Monitor Interest Rates: Interest rates play a significant role in property affordability. Be aware of any changes to the official cash rate and how they may impact your borrowing capacity.

- Stay Flexible: The property market can be unpredictable, so it’s essential to stay flexible and adjust your strategy when necessary.