Investing in real estate in Australia can be a lucrative venture, offering opportunities for both capital growth and rental income. If you’re considering entering the Australian property market, understanding the key steps and strategies can set you on the path to success. Here’s a comprehensive guide to help you navigate the process of real estate investment in Australia.

1. Research the Market

Before diving in, it’s crucial to research the Australian property market thoroughly. Analyze different regions and cities to identify areas with strong growth potential. Key factors to consider include economic conditions, infrastructure development, and local demand for rental properties.

2. Set Clear Investment Goals

Define what you want to achieve with your real estate investment. Are you looking for long-term capital gains, steady rental income, or a combination of both? Your investment goals will influence your property choice and strategy.

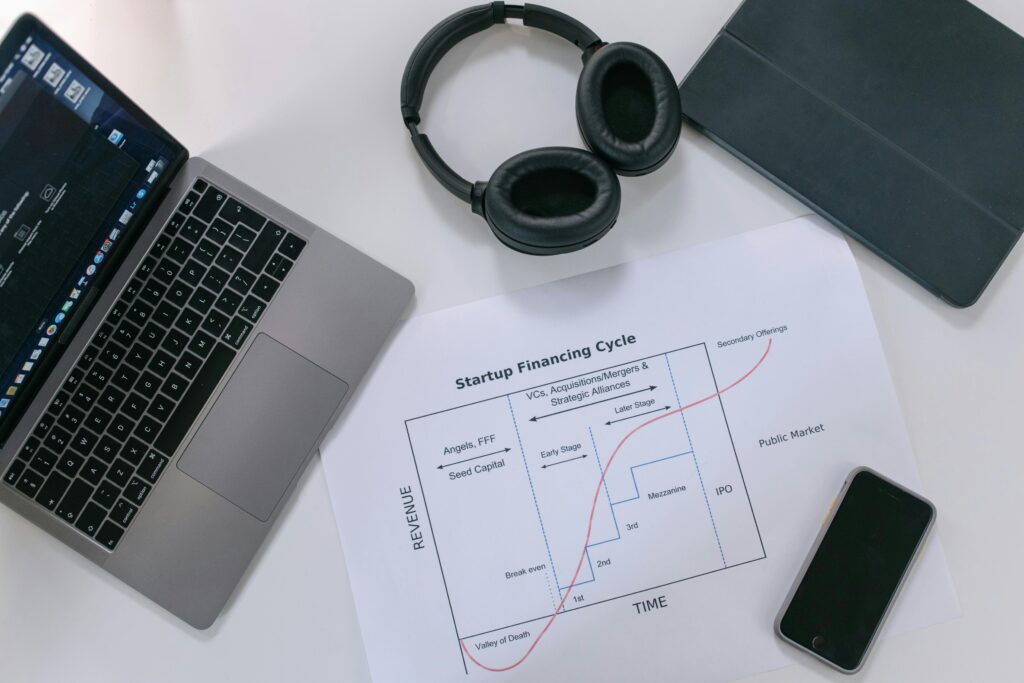

3. Understand Financing Options

Explore various financing options available to you. This includes conventional mortgages, investment loans, and leveraging your existing assets. It’s advisable to consult with a financial advisor to determine the best financing strategy for your situation.

4. Choose the Right Property

Selecting the right property is critical. Consider factors such as location, property type, and potential for future value appreciation. Properties in high-demand areas with good amenities and infrastructure typically offer better returns.

5. Conduct Due Diligence

Perform thorough due diligence before making a purchase. This includes inspecting the property, reviewing legal documents, and checking for any zoning or regulatory issues. Engaging a professional property inspector and legal advisor can help ensure a smooth transaction.

6. Understand Legal and Tax Implications

Familiarize yourself with the legal and tax obligations associated with real estate investment in Australia. This includes understanding property taxes, capital gains tax, and compliance with local regulations. Consulting a tax advisor can provide clarity on your tax responsibilities.

7. Manage Your Investment

Once you’ve acquired a property, effective management is key to maximizing returns. This includes maintaining the property, handling tenant relations, and staying informed about market trends.

Investing in real estate in Australia offers promising opportunities if approached with careful planning and informed decision-making. By researching the market, setting clear goals, understanding financing options, and conducting thorough due diligence, you can position yourself for successful real estate investments.